Landfill Tax: Difference between revisions

m ref added |

add new link and picture |

||

| (33 intermediate revisions by 4 users not shown) | |||

| Line 1: | Line 1: | ||

The Landfill Tax in the UK is applied to wastes that go to | [[Category:Legislation & Policy]][[Category:Economics]][[Category:Targets & Metrics]] | ||

The [[Landfill Tax]] ([[LFT]]) in the UK is applied to wastes that go to [[Landfill]], which increases the overall cost of [[Landfill]]. | |||

== Overview == | == Overview == | ||

The Landfill Tax in the UK is applied to wastes that go to | The [[Landfill Tax]] in the UK is applied to wastes that go to [[Landfill]], which increases the overall cost of [[Landfill]]. The tax is applied per tonne of waste, applied in addition to the [[Gate Fee|gate fee]] charged by the landfill operator, who is responsible for charging and collecting the tax from the disposer of the waste, and accounting for the tax and paying it to [[HMRC]]. In 2020/21 the amount of Landfill Tax collected was £566 million which is 11.7% lower than the previous financial year <ref name='hmrcstat'>[https://www.gov.uk/government/statistics/environmental-taxes-bulletin/environmental-taxes-bulletin-commentary-june-2021#landfill-tax-receipts-and-declarations HMRC National Statistical Environmental Bulletin commentary (June 2021)]</ref> and VAT is charged on the [[Landfill]] [[Gate Fee|gate fee]] and the Landfill Tax. | ||

'''Extract from Environmental Bulletin (Figure 4: Total Landfill Tax Receipts by Financial Year, in £million)''' | |||

[[File:LFT Receipts.png|none|700px|Figure 4: Total LFT receipts by financial year, in £million - Environmental Bulletin]] | |||

In November 2021 [[wikipedia: HM Treasury|HM Treasury]] launched a review of the Landfill Tax<ref>https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1037307/LfT_review_CfE.pdf</ref>. | |||

== History == | == History == | ||

| Line 8: | Line 16: | ||

== Arrangements == | == Arrangements == | ||

The amount of tax levied varies according to whether it is is active or inactive waste going to landfill. | The amount of tax levied varies according to whether it is is '''active''' or '''inactive''' waste going to landfill <ref>[https://www.gov.uk/government/publications/excise-notice-lft1-a-general-guide-to-landfill-tax/excise-notice-lft1-a-general-guide-to-landfill-tax General Guide to Landfill Tax LFT1]</ref>. | ||

Inactive waste covers most materials used in a building's fabric as well as earth excavated for foundations. Most forms of concrete, brick, glass, soil, clay and gravel are classified as inactive. [[ | '''Inactive''' waste covers most materials used in a building's fabric as well as earth excavated for foundations. Most forms of concrete, brick, glass, soil, clay and gravel are classified as inactive. [[HMRC]] has further clarified that waste with [[LoI|Loss of Ignition Testing]] ([[LoI]]) demonstrating an organic content of less than 10% is required to demonstrate the waste is inactive. | ||

Active waste covers all other forms of waste such as wood, duct work, piping, plastics and mixed residual waste. Operators have in the past mitigated their tax liability by the utilization of exemptions of the Landfill Tax for certain sites (i.e. quarries that require restoration with inert soils) and for certain uses in a landfill sites (i.e. by using waste derived stone to replace virgin stone used in engineering/construction of a site). | '''Active''' waste covers all other forms of waste such as wood, duct work, piping, plastics and mixed residual waste. Operators have in the past mitigated their tax liability by the utilization of exemptions of the Landfill Tax for certain sites (i.e. quarries that require restoration with inert soils) and for certain uses in a landfill sites (i.e. by using waste derived stone to replace virgin stone used in engineering/construction of a site). | ||

== Rates == | == Rates (Active/Inactive) == | ||

The Landfill Tax started out at modest rates and annual increases, and was then increased by £8 per tonne from 2006 to 2014 before moving closer to inflationary increases thereafter, with the rate from 1st April 2019 announced at £91.35 for active and £2.90 for inactive waste and from 1st April 2020 £94.15 for active and £3.00 for inactive waste. | The Landfill Tax started out at modest rates and annual increases, and was then increased by £8 per tonne from 2006 to 2014 before moving closer to inflationary increases thereafter, with the rate from 1st April 2019 announced at £91.35 for active and £2.90 for inactive waste and from 1st April 2020 £94.15 for active and £3.00 for inactive waste. | ||

From 2015 the Scottish Landfill Tax<ref>[https://revenue. | From 2015 the Scottish Landfill Tax<ref>[https://revenue.scot/scottish-landfill-tax Scottish Landfill Tax]</ref> came into force (at the same rates England and set for the same rate in 2019/20) and from April 2018 Wales <ref>[http://www.legislation.gov.uk/wsi/2018/131/made Landfill Disposals Tax (Wales)]</ref> set its own landfill tax known as the Landfill Disposal Tax (with a slightly higher rate for active waste 2019/20 of £91.70). For 2020/21 Wales, Scotland, Northern Ireland and England will be aligned. <ref>[https://www.letsrecycle.com/news/latest-news/uk-landfill-tax-rates-similar/ Letsrecycle Article]</ref><ref>[https://www.gov.uk/government/publications/excise-notice-lft1-a-general-guide-to-landfill-tax/excise-notice-lft1-a-general-guide-to-landfill-tax#two-rates-of-tax Excise Note LFT1 updated 9 April 2020]</ref> | ||

To put the rates into context the landfill [[Gate Fee|gate fee]]s in 2018 were stated as £14.00 to £28.00 with the tax representing therefore up to 5 times the [[Gate Fee|gate fee]]. | To put the rates into context the landfill [[Gate Fee|gate fee]]s in 2018 were stated as £14.00 to £28.00 <ref>Letsrecycle.com</ref> with the tax representing therefore up to 5 times the [[Gate Fee|gate fee]]. | ||

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

! Date of Change !! Standard Rate (Active Waste) !! Lower Rate (Inactive Waste) | ! Date of Change !! Standard Rate ('''Active Waste''') !! Lower Rate ('''Inactive Waste''') | ||

|- | |||

| 01.10.96 || style='text-align:center;' |£7.00 || style='text-align:center;' |£2.00 | |||

|- | |||

| 01.04.99 || style='text-align:center;' |£10.00 || style='text-align:center;' |£2.00 | |||

|- | |||

| 01.04.00 || style='text-align:center;' |£11.00 || style='text-align:center;' |£2.00 | |||

|- | |||

| 01.04.01 || style='text-align:center;' |£12.00 || style='text-align:center;' |£2.00 | |||

|- | |||

| 01.04.02 || style='text-align:center;' |£13.00 || style='text-align:center;' |£2.00 | |||

|- | |||

| 01.04.03 || style='text-align:center;' |£14.00 || style='text-align:center;' |£2.00 | |||

|- | |- | ||

| 01. | | 01.04.04 || style='text-align:center;' |£15.00 || style='text-align:center;' |£2.00 | ||

|- | |- | ||

| 01.04. | | 01.04.05 || style='text-align:center;' |£18.00 || style='text-align:center;' |£2.00 | ||

|- | |- | ||

| 01.04. | | 01.04.06 || style='text-align:center;' |£21.00 || style='text-align:center;' |£2.00 | ||

|- | |- | ||

| 01.04. | | 01.04.07 || style='text-align:center;' |£24.00 || style='text-align:center;' |£2.00 | ||

|- | |- | ||

| 01.04. | | 01.04.08 || style='text-align:center;' |£32.00 || style='text-align:center;' |£2.50 | ||

|- | |- | ||

| 01.04. | | 01.04.09 || style='text-align:center;' |£40.00 || style='text-align:center;' |£2.50 | ||

|- | |- | ||

| 01.04. | | 01.04.10 || style='text-align:center;' |£48.00 || style='text-align:center;' |£2.50 | ||

|- | |- | ||

| 01.04. | | 01.04.11 || style='text-align:center;' |£56.00 || style='text-align:center;' |£2.50 | ||

|- | |- | ||

| 01.04. | | 01.04.12 || style='text-align:center;' |£64.00 || style='text-align:center;' |£2.50 | ||

|- | |- | ||

| 01.04. | | 01.04.13 || style='text-align:center;' |£72.00 || style='text-align:center;' |£2.50 | ||

|- | |- | ||

| 01.04. | | 01.04.14 || style='text-align:center;' |£80.00 || style='text-align:center;' |£2.50 | ||

|- | |- | ||

| 01.04. | | 01.04.15 || style='text-align:center;' |£82.60 || style='text-align:center;' |£2.60 | ||

|- | |- | ||

| 01.04. | | 01.04.16 || style='text-align:center;' |£84.40 || style='text-align:center;' |£2.65 | ||

|- | |- | ||

| 01.04. | | 01.04.17 || style='text-align:center;' |£86.10 || style='text-align:center;' |£2.70 | ||

|- | |- | ||

| 01.04. | | 01.04.18 || style='text-align:center;' |£88.95 || style='text-align:center;' |£2.80 | ||

|- | |- | ||

| 01.04. | | 01.04.19 || style='text-align:center;' |£91.35 || style='text-align:center;' |£2.90 | ||

|- | |- | ||

| 01.04. | | 01.04.20 || style='text-align:center;' |£94.15 || style='text-align:center;' |£3.00 | ||

|- | |- | ||

| 01.04. | | 01.04.21 || style='text-align:center;' |£96.70 || style='text-align:center;' |£3.10 | ||

|- | |- | ||

| 01.04. | | 01.04.22 || style='text-align:center;' |£98.60 || style='text-align:center;' |£3.15 | ||

|- | |- | ||

| 01.04. | | 01.04.23 || style='text-align:center;' |£102.10 || style='text-align:center;' |£3.25 | ||

|- | |- | ||

| 01.04. | | 01.04.24 || style='text-align:center;' |£103.70 || style='text-align:center;' |£3.30 | ||

|- | |||

| 01.04.25 || style='text-align:center;' |£126.15 || style='text-align:center;' |£4.05 | |||

|} | |} | ||

== Impact == | == Impact == | ||

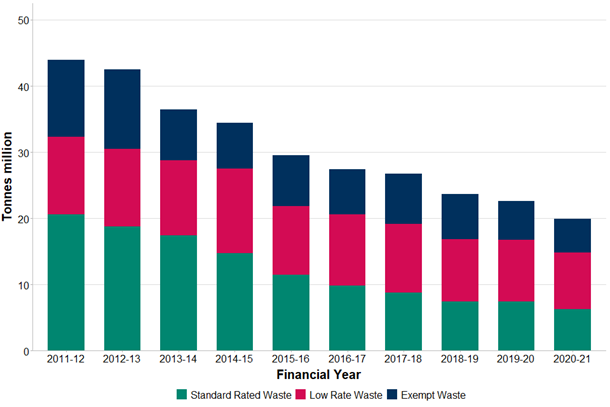

Landfill tonnage of active waste at standard rates has progressively dropped with the introduction and progressive increase in Landfill Tax, with inactive waste at lower rates remaining reasonably static: | Landfill tonnage of active waste at standard rates has progressively dropped with the introduction and progressive increase in Landfill Tax, with inactive waste at lower rates remaining reasonably static <ref name='hmrcstat' />: | ||

'''Extract from Environmental Tax Bulletin (Figure 5: Total Landfill tonnage declared split by taxable tonnage, taxable tonnage of which relived and exempt tonnage by financial year, in millions of tonnes):''' | |||

[[File:Landfill Tonnage Over Time.png|none|700px|Landfill Tonnage Over Time]] | |||

[[File: | There is evidence to suggest that the impact of increased recycling as a result of the Landfill Tax has 'flat-lined' since around 2014, although the rates of tax announced<ref>https://www.gov.uk/government/publications/landfill-tax-rates-for-2024-to-2025</ref> for 2025 represent an increase of 22% on rates in 2024<ref>Graph by [[Monksleigh]]</ref>: | ||

[[File:Picture1 lft and recycling.png|alt=Landfill Tax vs Recycling Rates|center|700px]] | |||

== Landfill Tax Credit Scheme == | == Landfill Tax Credit Scheme == | ||

Revision as of 17:11, 11 March 2024

The Landfill Tax (LFT) in the UK is applied to wastes that go to Landfill, which increases the overall cost of Landfill.

Overview

The Landfill Tax in the UK is applied to wastes that go to Landfill, which increases the overall cost of Landfill. The tax is applied per tonne of waste, applied in addition to the gate fee charged by the landfill operator, who is responsible for charging and collecting the tax from the disposer of the waste, and accounting for the tax and paying it to HMRC. In 2020/21 the amount of Landfill Tax collected was £566 million which is 11.7% lower than the previous financial year [1] and VAT is charged on the Landfill gate fee and the Landfill Tax.

Extract from Environmental Bulletin (Figure 4: Total Landfill Tax Receipts by Financial Year, in £million)

In November 2021 HM Treasury launched a review of the Landfill Tax[2].

History

The Landfill Tax was introduced in 1996 and was the UK's first environmental tax. The tax was seen as a key mechanism in enabling the UK to meet its targets set out in the Landfill Directive for the reduction in the landfilling of Biodegradable Municipal Waste. Through increasing the overall cost of landfill, recycling and other waste treatment technologies with higher gate fees (which divert biodegradable waste from landfill) were/are made to become more financially attractive.

Arrangements

The amount of tax levied varies according to whether it is is active or inactive waste going to landfill [3].

Inactive waste covers most materials used in a building's fabric as well as earth excavated for foundations. Most forms of concrete, brick, glass, soil, clay and gravel are classified as inactive. HMRC has further clarified that waste with Loss of Ignition Testing (LoI) demonstrating an organic content of less than 10% is required to demonstrate the waste is inactive.

Active waste covers all other forms of waste such as wood, duct work, piping, plastics and mixed residual waste. Operators have in the past mitigated their tax liability by the utilization of exemptions of the Landfill Tax for certain sites (i.e. quarries that require restoration with inert soils) and for certain uses in a landfill sites (i.e. by using waste derived stone to replace virgin stone used in engineering/construction of a site).

Rates (Active/Inactive)

The Landfill Tax started out at modest rates and annual increases, and was then increased by £8 per tonne from 2006 to 2014 before moving closer to inflationary increases thereafter, with the rate from 1st April 2019 announced at £91.35 for active and £2.90 for inactive waste and from 1st April 2020 £94.15 for active and £3.00 for inactive waste.

From 2015 the Scottish Landfill Tax[4] came into force (at the same rates England and set for the same rate in 2019/20) and from April 2018 Wales [5] set its own landfill tax known as the Landfill Disposal Tax (with a slightly higher rate for active waste 2019/20 of £91.70). For 2020/21 Wales, Scotland, Northern Ireland and England will be aligned. [6][7]

To put the rates into context the landfill gate fees in 2018 were stated as £14.00 to £28.00 [8] with the tax representing therefore up to 5 times the gate fee.

| Date of Change | Standard Rate (Active Waste) | Lower Rate (Inactive Waste) |

|---|---|---|

| 01.10.96 | £7.00 | £2.00 |

| 01.04.99 | £10.00 | £2.00 |

| 01.04.00 | £11.00 | £2.00 |

| 01.04.01 | £12.00 | £2.00 |

| 01.04.02 | £13.00 | £2.00 |

| 01.04.03 | £14.00 | £2.00 |

| 01.04.04 | £15.00 | £2.00 |

| 01.04.05 | £18.00 | £2.00 |

| 01.04.06 | £21.00 | £2.00 |

| 01.04.07 | £24.00 | £2.00 |

| 01.04.08 | £32.00 | £2.50 |

| 01.04.09 | £40.00 | £2.50 |

| 01.04.10 | £48.00 | £2.50 |

| 01.04.11 | £56.00 | £2.50 |

| 01.04.12 | £64.00 | £2.50 |

| 01.04.13 | £72.00 | £2.50 |

| 01.04.14 | £80.00 | £2.50 |

| 01.04.15 | £82.60 | £2.60 |

| 01.04.16 | £84.40 | £2.65 |

| 01.04.17 | £86.10 | £2.70 |

| 01.04.18 | £88.95 | £2.80 |

| 01.04.19 | £91.35 | £2.90 |

| 01.04.20 | £94.15 | £3.00 |

| 01.04.21 | £96.70 | £3.10 |

| 01.04.22 | £98.60 | £3.15 |

| 01.04.23 | £102.10 | £3.25 |

| 01.04.24 | £103.70 | £3.30 |

| 01.04.25 | £126.15 | £4.05 |

Impact

Landfill tonnage of active waste at standard rates has progressively dropped with the introduction and progressive increase in Landfill Tax, with inactive waste at lower rates remaining reasonably static [1]:

Extract from Environmental Tax Bulletin (Figure 5: Total Landfill tonnage declared split by taxable tonnage, taxable tonnage of which relived and exempt tonnage by financial year, in millions of tonnes):

There is evidence to suggest that the impact of increased recycling as a result of the Landfill Tax has 'flat-lined' since around 2014, although the rates of tax announced[9] for 2025 represent an increase of 22% on rates in 2024[10]:

Landfill Tax Credit Scheme

Landfill operators are able to make payments to organisations that qualify under the Landfill Communities Fund under the Landfill Tax Credit Scheme, rebating a proportion of the landfill tax collected for qualifying community or environmental projects in the vicinity of a landfill sites and is regulated by ENTRUST, with £37.8 million[1] rebated in the 2017/18 tax year.

References

- ↑ 1.0 1.1 1.2 HMRC National Statistical Environmental Bulletin commentary (June 2021)

- ↑ https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1037307/LfT_review_CfE.pdf

- ↑ General Guide to Landfill Tax LFT1

- ↑ Scottish Landfill Tax

- ↑ Landfill Disposals Tax (Wales)

- ↑ Letsrecycle Article

- ↑ Excise Note LFT1 updated 9 April 2020

- ↑ Letsrecycle.com

- ↑ https://www.gov.uk/government/publications/landfill-tax-rates-for-2024-to-2025

- ↑ Graph by Monksleigh